Studies from outside the United States show a pay penalty—in the United Kingdom, as high as 22% to 26%. About half of the pay gap, 13% among women, is "explained" by worker characteristics, but the remaining 3% to 10% is unexplained . The case of Norway suggests the importance of an institutional setting characterized by relatively strong employment protection that includes part-time workers. Partly as a consequence of this, a large proportion of Norwegian women are working part time.

In contrast, more part-time work does not reduce current wages, although it leads to negative longer-term wage effects . A study of women's part-time work and wage penalties, using fixed-effects estimation, finds the smallest penalties for part-time employment where female labor force participation rates are lowest . A codified measure to ensure rights for part-time workers would need to include provisions for wage fairness and pro-rated benefit coverage.

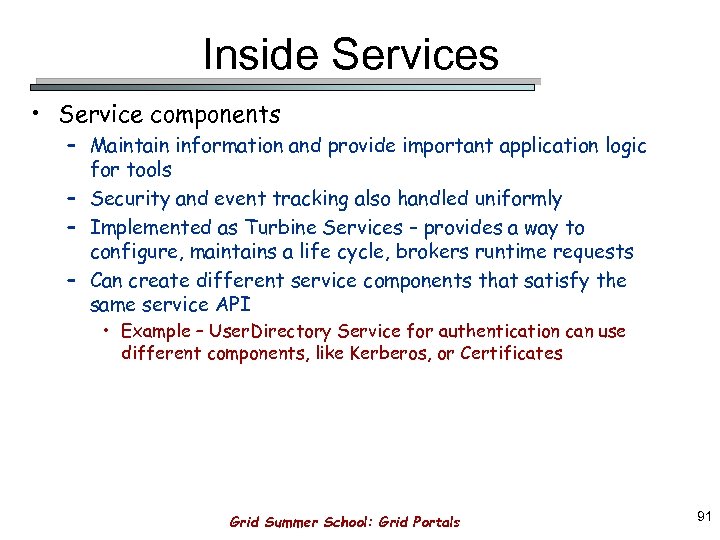

"These conditions may be determined in proportion to hours of work, contributions or earnings." . In the United States, San Francisco's Formula Retail Employee Rights Ordinances have such parity for part-time workers (San Francisco Office of Labor Standards Enforcement 2020, see Section 3300G.5 ). However, having significantly reduced per-hour compensation for the same work characteristics, hurts part-time workers, whether they are working part-time hours for either the economic or noneconomic reasons. The hourly wage penalty for working part time, in the recent U.S. labor market, is a 20% reduction in earnings per hour, even after one's education, experience, occupation, and industry are taken into account. The part-time workers' relative wage gap is thus on par with observed gender and racial wage gaps in the United States, and is similarly persistent and inequitable. Indeed, the wage penalty is measurably higher now than it was a decade and a half ago when Hirsch did his analysis with the same CPS data.

In addition, the over 4 million U.S. workers in part-time jobs who prefer to work full-time hours pay an even stiffer penalty. For example, part-time work might command a premium if these two part-time positions generate greater productivity than one full-time job sufficient to more than overcome the fixed costs. Work schedules that often do not provide as many hours as they want or need are a significant challenge faced by many part-time workers. The employer also must use a transparent and nondiscriminatory process to distribute the hours of work among those existing employees. Employers are not obliged to allocate those hours to existing employees in the event the additional hours would result in premium-owed overtime hours . The number of people working in part-time jobs in the U.S. economy who explicitly prefer to work full-time hours in 2019 was about 4.3 million.

But because "there is no legal definition provided by the Department of Labor for full-time or part-time employment," Reynolds says, each organization will generally set their own. In Muse career coach Jennifer Sukola's experience, people with part time jobs typically work 15 to 29 hours a week. However, some employers will consider anyone working less than 40 hours a week a part-time employee. The "gross" or "raw" wage gap—a simple comparison of part-time and full-time hourly wages —typically is considered as the average wage differential between part-time and full-time workers in a given sample.

Much of the research starts by estimating the "unadjusted" or "raw" wage difference between part-time and full-time jobs or work per hour. This is an important first estimate because it relates most directly to workers' choices in the labor market regarding hours of work and to consequences of those choices for their income. Estimations typically then adjust this raw differential for demographic and human capital factors such as age, experience in the labor market, education, etc., to get an "adjusted" penalty . This typically lessens the size of the penalty, by controlling for the additional experience and education that full-time workers have compared with part-time workers, on average (Baffoe-Bonnie 2004). In addition, full-time workers are more likely to have better benefits, like pensions, and be represented by unions (Bishow 2015; BLS 2019). It begins with a condensed review of the existing literature and descriptive evidence on the meaning and measurement of part-time compensation differentials.

It then explains how we replicated and updated a systematic analysis of the part-time wage penalty that was definitive but used data from 1995 to 2002. In brief, as we explain, we pool the cross-sectional data from the U.S. Current Population Survey Outgoing Rotation Group files from 2003 through 2018 to form a large data set with more than 1.7 million observations. Following the methodology discussion is a section presenting key findings.

As we discuss in more detail, the results show that the size of the wage penalty not only is substantial, but it has increased in size since the period ending in the early 2000s. The size of the wage penalties by race/ethnicity, gender, reason for working part time, and number of weekly hours are reported. The law defines full-time work as at least 30 hours per week or 130 hours per month. Companies that meet the threshold for size must either offer an affordable health insurance plan to these full-time employees or pay a penalty for not offering coverage. No company, regardless of size, is required by the federal government to subsidize health insurance for part-time employees who work fewer than 30 hours per week or 130 hours per month. When employers must staff a position on a full-time basis, job sharing is an option.

Job sharing is a form of part-time employment in which one position is filled with two or more part-time employees. At an agency's discretion and within available resources, each job sharer can work up to 32 hours per week. Agencies also benefit from having the special skills and abilities of two unique individuals.

The labor demand side provides a foundation regarding why employers may favor creation of more jobs with part-time hours, or fewer in favor of more full-time positions. This would lead employers to curb the ratio of part-time to full-time jobs. The most common benefits include health insurance, as well as dental, vision, and life insurance. Employers that offer insurance will usually pay for some (or even all!) of the monthly cost of the policy. Most full-time employees will also be eligible for paid time off through federal holidays, vacation days, and sick days. Much like the number of hours you'll work in a part-time job, the benefits you'll be eligible for will depend on where you work.

Many companies choose to only offer benefits—such as dental insurance or a childcare allowance—to full-time employees. Others choose to offer some or all of their benefits to part-time workers as well. A few of the benefits commonly offered to part-time employees are paid holidays, life insurance, and paid time off , Reynolds says.

Part-time work is an essential component of the labor market for both employers and employees. It is more of a blessing if a part-time job provides the incumbent worker with the number of work hours and schedule that meets their needs or preferences for working, without unduly sacrificing other aspects. Indeed, part-time positions originated to integrate those who might otherwise prefer to be entirely out of the labor force.

Many employers opt to provide benefits that are not required by law, such as dental insurance and paid vacation time. For these purposes, an employer can define part-time employment in whatever way that makes sense for the business. However, one important benefit of these perks is to contribute to employee morale and encourage workers to stay with a company. Typically in Canada, part-time employees don't qualify for health, insurance or company retirement benefits. If you're working a part-time position and a full-time job, then you are likely covered with your full-time company.

However, if you only work part-time, then you can ask your employer about eligibility for healthcare and life insurance or any retirement benefits that may be available. In Canada, all employers must pay into Employment Insurance and the Canada Pension Plan . These deductions come off of an employee's paycheque and submitted on your behalf. However, additional benefits are not guaranteed for part-time workers. The fully adjusted wage penalty, which controls also for the worker's industry and occupation in which they are employed, is 19.8%.

This suggests that part-time workers get paid about 20% less than otherwise comparable full-timers simply because they are in part-time jobs, independent of whatever occupation and industry they work in. Thus, we infer that about one-third of the only partially adjusted wage gap is attributable to part-time workers being employed in certain lower-paying sectors or job types. Nevertheless, two-thirds of the wage gap is not explained by their industry or occupation of employment. In the earlier period, "measurable" characteristics accounted for 60% of the raw wage penalty . The fully adjusted wage penalty for part-time workers is markedly higher recently—about 20% compared with 16% in the earlier, 1995–2002 period. The increase is surprising since the skills required of part-time workers actually rose between 2007 and 2017 .

Smaller companies may not be required to give employee benefits like sick leave, vacation time, or health insurance to full-time workers, even if they work 40 hours or more per week. There are also salary thresholds under the federal Fair Labor Standards Act that can affect your job classification. Part-time employment in Australia involves a comprehensive framework. Part-time employees work fewer hours than their full-time counterparts within a specific industry. Part-time employees within Australia are legally entitled to paid annual leave, sick leave, and having maternity leave etc. except it is covered on a 'pro-rata' basis depending on the hours worked each week.

Furthermore, as a part-time employee is guaranteed a ular roster within a workplace, they are given an annular salary paid each week, fortnight, or month. Employers within Australia are obliged to provide minimum notice requirements for termination, redundancy and change of rostered hours in relation to part-time workers. As of January 2010, the number of part-time workers within Australia was approximately 3.3 million out of the 10.9 million individuals within the Australian workforce.

When people in the U.S. talk about benefits, health insurance is usually top of mind. While some employers do offer health insurance to some or all part-time employees, many do not. So even if your employer considers you a part-time employee because you work less than 40 hours a week, you may still be legally entitled to health insurance coverage. For many office-based part-time jobs, employees will have a set schedule where they work the same hours every week, Reynolds says.

However, these hours may vary by season or based on certain company needs like large projects and events. Outside of office work, part-time employees may be more subject to fluctuating hours and shifts. Job sharing is a form of part-time employment in which the schedules of two or more part-time employees are arranged to cover the duties of a single full-time position. Generally, a job sharing team means two employees at the same grade level but other arrangements are possible. Job sharers are subject to the same personnel policies as other part-time employees.

Job sharing does not necessarily mean that each job sharer works half-time, or that the total number of hours is 40 per week. Part-time jobs during the period 2003 to 2018 averaged 52.4% less wages per hour compared with earnings from full-time jobs. When factoring in just the effects of location and state of the economy in subperiods , the "raw" wage penalty is 53.1% . This represents a substantial size reduction in absolute earnings per hour, suggesting that part-time workers earn less than 50 cents per hour on the dollar earned by their full-time worker counterparts. Furthermore, this represents a substantial increase in the size of the unadjusted wage penalty from 1995–2002, which was on the order of 33% (between the 46% found for men and 22% for women ). Thus, hourly wage rates for part-timers compared with otherwise comparable full-timers might reflect either a negative wage penalty or a positive pay premium.

Certain part-time workers indeed generate such gains (i.e., "rents") for their employers, either from their relatively higher productivity per hour or relatively lower wage rates paid . Thus, depending on the bargaining power of employers or employees, there may be a wage premium for some and a wage penalty for others (Jepsen et al. 2005; O'Dorchai, Plasman, and Rycx 2007). If you hire temporary part-time employees to help carry the workload, you avoid that hassle, while giving your full-time employees an extra level of support. Part-time workers can also fill in for employees taking sick or maternity leave, and long-term part-time employees can work schedules not covered by full-time employees. For example, if your company has retail customers or offers after-hours technical support, part-time staff could help with night and weekend hours, so you don't have gaps in staffing. Furthermore, "involuntary" part-time work is more widespread than conventional measures show.

A forthcoming report from the Center for Law and Social Policy creates a more complete picture than BLS measures of "involuntary" part-time working, for three reasons. One is because the former captures part-timers who want to work more hours, but not necessarily full time. A second is because part-time workers who hold multiple jobs to piece together full-time hours are actually not counted as part-time workers by BLS. Third and finally, because working parents who take part-time jobs because of "child care problems," which might include a lack of affordability or availability, are actually not counted as involuntary part-time workers. Policy priorities should include an array of reforms directed toward all part-time jobs, not just its incumbents, to address the large and apparently growing inequity in both wages and in benefits. Reforms could specifically promote more pay parity and income-earning opportunities for workers with relatively shorter weekly hours, specifically for those who work part time but prefer to work longer or full-time hours.

In Canada, part-time workers are those who usually work fewer than 30 hours per week at their main or only job. In 2007, just over 1 in every 10 employees aged 25 to 54 worked part-time. A person who has a part-time placement is often contracted to a company or business in which they have a set of terms they agree with. 'Part-time' can also be used in reference to a student who works only few hours a day. Usually students from different nations (India, China, Mexico etc.) prefer Canada for their higher studies due to the availability of more part-time jobs. The Fair Labor Standards Act, which sets federal regulations for wages and overtime pay, does not make any distinction between full- and part-time workers.

Employees are covered by the law's provisions whether they work 15 hours per week or 50. According to the FLSA, no matter how many hours an employee works, an employer cannot pay less than $7.25 per hour or the applicable state minimum wage. FLSA also sets parameters for employing minors, and these rules are also not affected by whether an employee's schedule meets a minimum number of hours.

As the name suggests, part-time workers have fewer hours than a full-time employee. Part-time jobs typically require no more than 35 hours per week, and may be as few as 5-10 hours. Unlike full-time employees, part-time employees are not guaranteed the same number of hours or shifts each week. For example, a part-time cashier at a grocery store may only work 15 hours one week, and then 20 hours the following week. Part-time workers sometimes have the option of picking up additional shifts to cover for coworkers who call in sick, or for working extra hours during a particularly busy time of the year.

Among Australia's "casual" labor contracts, part-time workers explicitly lack long-term job security and social insurance security protections . This lack of benefits explains the entire pay premium found for workers working part time there and in South Africa (Rodgers 2004; Posel and Muller 2008; Booth and Wood 2008). However, when controlling for unobserved individual heterogeneity using panel data, part-time working men and women in Australia and in Germany typically earn an hourly pay premium relative to those in full-time jobs. Part-time work makes it easier to take care of housework and family work after the birth of a child and to continue to work or to get back to work after a baby break and thus reconcile family and work. Productivity of part-time workers can be higher than that of full-time workers because of lower stress, lower absenteeism, better work–life balance, and a more flexible work organization. Employees who are not fully resilient for health reasons may remain longer in part-time employment and it can be a smooth transition into retirement.

Working less fits the lifestyle of simple living and earning and spending less can contribute to climate change mitigation. These staff members are eligible, generally on a pro rata basis, for all benefits and pay premiums. For employees scheduled to work less than 30 hours per week, Duke does not make contributions to health care insurance premiums. In addition, employees will have benefit accumulations suspended during periods of layoff of 30 calendar days or more. However, they may provide for the continuation of their group life and health care insurance coverage during the period of layoff by making arrangements for the payment of premiums as required by the applicable policies. On the other hand, part-time employees are usually not eligible for company-sponsored benefits such as health insurance or retirement plans.

Some may offer education or training stipends, certain holidays off or employee discounts, especially for jobs in retail and food service. In terms of earnings, you'll find that many full-time employees are paid a little more than their part-time counterparts, especially if they have specialized skills. It wouldn't be unusual to see a pay increase if you change from a part-time role to a full-time role; you may even see your compensation restructured entirely, if you are paid a flat salary rather than hourly. Compared to part-time employees, full-time employees may also have more job responsibilities and opportunities for career progression, such as getting a promotion to a managerial role. However, there are still plenty of high-paying part-time jobs, such as nannies and customer service representatives.

Department of Labor does not have a standard, it is important to note that the Affordable Care Act does – if you work 30 hours or more per week or 130 hours per month, the ACA considers you to be a full-time employee. That can positively or negatively affect your ability to obtain health care or other benefits your employer provides to full-time workers, so it is important to understand the distinction as it relates to your job. Don't be afraid to ask for an explanation if you feel the job is not classified correctly. Your company should tell you at the time you are hired if you are exempt or nonexempt and be able to explain how that classification was decided. When job sharers want to work on alternate weeks, certain scheduling requirements must be met.

In order for a part-time employee to be regularly scheduled -- and eligible to earn leave-- he or she must have one hour of work scheduled in each week of the bi-weekly pay period. Also, a part-time employee may not be scheduled for more than 32 hours per week. Within these requirements, one job sharer could be scheduled for 32 hours in week A and in week B. The employees would have to take annual leave for the one hour in the week he or she wanted to be off.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.